Accounting for Purchase Discounts Entry, Example, and More

The purchases account is debited when purchases are made against a credit of cash or trade payables. Net purchases, in accounting, mean the total amount of purchases made less any discounts received, goods returned, allowances, and tax. The same as the perpetual inventory system, there is a journal entry needed under the gross method to record the adjustment of discount lost.

- The company must publish its financial information at the end of the month or quarterly–far sooner than ninety days.

- On 1st January, Dolphin Inc. purchased goods worth $2,000 from Blenda Co.

- However, the supplier also offers a purchase discount of 5% on the transaction if Red Co. pays the amount in 10 days.

- When a specific bad debt is identified, the allowance for doubtful accounts is debited (which reduces the reserve) and the accounts receivable account is credited (which reduces the receivable asset).

- This means if Company A pays the invoice within 10 days, they can take a 2% discount off the total order amount.

For example, on October 28, 2020, the company ABC Ltd. receives a discount of 2% on the $3,000 amount due when it makes a cash payment to its supplier on the last day of the discount period. During this process, they may also process those goods or convert them to another form. Usually, companies acquire goods for credit and pay for them at a later date. However, the company could benefit by paying less to its suppliers for the same products or services that it purchases. A purchase discount reduces the purchase price of certain inventories, fixed assets supplies, or any goods or products if the buying party can settle the amount in a given time period.

Is the purchase discount a revenue or expense?

Net sales is what remains after all returns, allowances and sales discounts have been subtracted from gross sales. When you create an allowance for doubtful accounts, you must record the amount on your business balance sheet. The balance sheet is a financial statement that looks at your company’s assets, liabilities, and equity. Some suppliers offer discounts of 1% or 2% from the sales invoice amount, if the invoice is paid in 10 days instead of the usual 30 days. For instance, let’s assume that a company purchases goods and the supplier’s sales invoice is $28,000 with terms of 1/10, net 30. This means that the company can deduct $280 (1% of $28,000) if it pays the invoice within 10 days.

However, in the net method, we record the purchase transaction at the net amount assuming that the payment would be made exactly on or before the agreed credit term. In this method, the amount of purchase recorded is the amount of invoice minus the cash discount. Purchase Discounts, Returns and Allowances are contra expense accounts that carry a credit balance, which is contrary to the normal debit balance of regular expense accounts. A purchase discount is a reduction in the amount repayable to a supplier.

What are sales allowances?

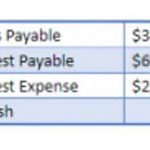

However, under the net method, we need to record adjusting entries to recognize the loss of the discount. This purchase discount of $60 will be offset with the purchase account and be cleared to zero at the end of the accounting period. The journal entry to record the settlement, including the purchase discount for Red Co., is below. Therefore, to set that off, trade discounts are offered which incentivizes buyers of a certain product to pay early, at a cheaper cost. If the business does not pay within the discount period and does not take the purchase discount it will pay the full invoice amount of 1,500 to the supplier and the discount is ignored.

Purchase Discount Not Taken

Purchase discounts, by nature, are supposed to decrease the purchase costs of the company. The difference in both the accounts is subsequently shown as a trade discount, and the remainder how to prepare and analyze a balance sheet is subsequently credited from the bank (the amount actually paid). 3/15 net 30 would mean that the company will get a 3% trade discount if the payment is settled within 15 days.

Purchase returns:

The company will be allowed to subtract a purchase discount of $100 (2% of $5,000) and remit $4,900 if the invoice is paid in 10 days. However, if the retailer fails to pay the invoice within the early payment discount period, the retailer is required to remit $1,000. In that case the retailer will credit Cash for $1,000; debit Accounts Payable for $980; and debit Purchase Discounts Lost for $20.

A buyer debits Accounts Payable if the original purchase was made on credit and the payment has not yet been made to a seller. This marketing tactic revolves around incentivizing first-time visitors to make a purchase. By presenting a discount or enticing offer, you’re trying to transform these first-time visitors into actual paying customers. This approach has been proven effective in bolstering fruitful relationships with consumers, particularly in creating a positive first impression of your brand. Therefore, it doesn’t just make them more likely to complete a purchase, but also increases the chances of them returning to your site in the future.

Products

Often a 1% or 2% discount that a buyer may deduct from the amount owed to a supplier (if

stated on the supplier’s invoice) for paying in 10 days instead of the customary 30 days. The

purchase discount is also referred to as an early-payment discount. An aspect that needs to be noted here is that only cash purchase discounts are included as subtractions from gross purchases. From an accounting perspective, it can be seen that when the purchase is made (and the invoice is generated), the journal entry to record this transaction is Debit – Purchases, and Credit – Accounts Payable. This is mainly an incentive to the purchasing party to settle the bill earlier than the prescribed date.

If a company purchases office equipment for $20,000 and the invoice has credit terms of 1/10, net 30, the company can deduct $200 (1% of $20,000) and remit $19,800 if the invoice is paid within 10 days. If that occurs, the company will record the equipment at its cost of $19,800. Another purchase discount is the one the suppliers offer on bulk buying. When a business buys in bulk regularly from a particular supplier, the supplier usually offers them discounts.