Impairment of Financial Assets IFRS 9

For further details, see the classification of financial assets and financial liabilities. On 1 January 20X1, Entity A lends $1 million to Entity B, with repayment of $1.5 million due on 31 December 20X4. No payments are required between these dates, resulting in an effective interest rate (EIR) of 10.7%. At initial recognition, Entity A estimated the 12-month ECL at $20,000. Paragraph IFRS 9.B5.5.35 and Example 12 (IFRS 9.IE74-77) specifically cite the provision matrix as a simplified approach to ECL measurement for trade receivables, contract assets, and lease receivables. To determine whether goodwill is impaired, it must be assigned to each of the acquirer’s cash-generating units or groups of cash-generating units that are expected to benefit from the combination’s synergies.

Disposal expenses are only the direct additional expenditures (not existing costs or overheads). Natalya Yashina is a CPA, DASM with over 12 years of experience in accounting including public accounting, financial reporting, and accounting policies. Understand what impairment is, how it differs from depreciation and amortization, and how to calculate and report it. Sometimes, however, companies must recognize an impairment against the asset under various circumstances as well.

It is recorded as a cost unless it relates to a revalued asset, where it is treated as a revaluation decrease. If there is a possibility that an asset is impaired, the asset’s recoverable value must be determined. Accounting regulations that require companies to mark their goodwill to market were a painful way to resolve the misallocation of assets that occurred during the dotcom bubble or during the subprime meltdown.

Significant increase in credit risk

Fair market value is the price the asset would fetch if it was sold on the market. This is sometimes described as the future cash flow the asset would expect to generate in continued business operations. The overall goal of asset impairment is to periodically evaluate a company’s assets to make sure the total value of the assets is not being overstated. An impaired asset is one that has a market value less than what is listed on the company’s balance sheet.

- Asset impairment can also smoothen the loss of sales when the asset is disposed of.

- A debit entry is made to “Loss from Impairment,” which will appear on the income statement as a reduction of net income, in the amount of $50,000 ($150,000 book value – $100,000 calculated fair value).

- An impaired asset is one that has a market value less than what is listed on the company’s balance sheet.

- The fair market value is the amount the asset could be sold for in the current market.

Management of the company should also perform an annual impairment assessment at least annually. Therefore, ABC Co. must record an impairment loss of $20,000 ($100,000 – $80,000). The impairment loss becomes a part of the Income Statement and reduces the profits of the company during the period. Once a company calculates the asset’s recoverable amount, it must compare it with the asset’s carrying value. Companies must always identify them and evaluate whether they have resulted in the impairment of their assets. Periodically evaluating the value of assets helps a company accurately record its asset value rather than overstating its asset value, which could lead to financial problems later on.

ABC Company, based in Florida, purchased a building many years ago at a historical cost of $250,000. It has taken a total of $100,000 in depreciation on the building and therefore has $100,000 in accumulated depreciation. The building’s carrying value, or book value, is $150,000 on the company’s balance sheet.

IOSCO publishes recommendations on the accounting for goodwill

In some situations, the most recent thorough computation of the recoverable amount from a previous period can be used in the current period’s impairment test for that asset. Kevin is currently the Head of Execution and a Vice President at Ion Pacific, a merchant bank and asset manager based Hong Kong that invests in the technology sector globally. Prior to joining Ion Pacific, Kevin was a Vice President at Accordion Partners, a consulting firm that works with management teams at portfolio https://adprun.net/impairment-definition-2/ companies of leading private equity firms. Impairment can be affected by internal factors (damage to assets, holding onto assets for restructuring, and others) or through external factors (changes in market prices and economic factors, as well as others). Prior to the adoption of the new FASB accounting rules, companies were allowed to amortize the goodwill from any acquisitions they made every quarter. Here’s an example of an impairment and how it’s recorded under GAAP rules.

13 Impairment of financial assets

Whether goodwill is impaired is assessed by considering the recoverable amount of the cash-generating unit(s) to which it is allocated. If any impairment exists, the accountant writes off the difference between the fair value and the carrying value. Fair value is normally derived as the sum of an asset’s undiscounted expected future cash flows and its expected salvage value, which is what the company expects to receive from selling or disposing of the asset at the end of its life. In future periods, the asset will be reported at its lower carrying value. Even if the impaired asset’s market value returns to the original level, GAAP states the impaired asset must remain recorded at the lower adjusted dollar amount.

Loan commitments and financial guarantee contracts

This is due to 12-month ECL being weighted by the probability of default (PD). An impaired asset is an asset that has a market value less than the value listed on the company’s balance sheet. When an asset is deemed to be impaired, it will need to be written down on the company’s balance sheet to its current market value. While calculating asset impairment under GAAP, it is important to be aware that undiscounted cash flows are used in the first step, while discounted cash flows are used in the second step. Another difference between the GAAP and IFRS policies is that GAAP does not allow recovery of impairment. Lower the carrying amount of any goodwill attributed to the cash-generating unit (group of units) first, and then pro-rata on the basis, reduce the carrying amounts of the unit’s other assets.

A test must be done and it may require a reduction in the reported amount of goodwill and a resulting impairment loss reported on the company’s income statement. When testing an asset for impairment, the total profit, cash flow, or other benefits that can be generated by the asset is periodically compared with its current book value. If the book value of the asset exceeds the future cash flow or other benefits of the asset, the difference between the two is written off, and the value of the asset declines on the company’s balance sheet. Instead, the standard mandates an entity to apply a default definition that aligns with the one used for internal credit risk management.

IAS 36 Impairment of Assets

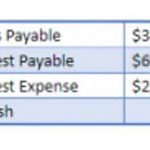

The impairment loss of $5,000 is entered on the debit side of the income statement, which reduces the net income. There’s also an entry to reduce the asset’s balance on the balance sheet by $5,000, and the asset’s account or an impairment loss account is credited $5,000. Impairment can have a negative impact on a business’s balance sheet and financial ratios because the market value is less than the book value. GAAP rules under the Financial Accounting Standards Board (FASB) are designed to ensure fair and transparent accounting of a business’s financials. With accurate financial information, investors can make sound investing decisions. If impairment is not recorded, the balance sheet and financial ratios will be inaccurate.

Furthermore, if an asset’s fair value reduces in the market, it may also cause impairment to it. Similarly, changes in the market can also impact the company adversely, causing impairment to its assets. Under generally accepted accounting principles (GAAP), assets are considered to be impaired when their fair value falls below their book value.

IFRS 9 does not provide a specific definition of ‘significant’, and the rationale behind this is explained in paragraph IFRS 9.BC5.171 of the basis for conclusions. Consequently, entities are expected to use judgement and establish their own criteria. IFRS 9.B5.5.7 explicitly states that a significant increase in credit risk usually occurs prior to a financial asset becoming credit-impaired or an actual default taking place.