Present Value PV: Definition, Formula & Calculation

In present value situations, the interest rate is often called the discount rate. Some individuals refer to present value problems as “discounted present value problems.” This example shows that if the $4,540 is invested today at 12% interest per year, compounded annually, it will grow to $8,000 after 5 years. The amount you would be willing to accept depends on the interest rate or the rate of return you receive. For example, suppose you want to know the value today of receiving $15,000 at the end of 5 years if a rate of return of 12% is earned.

Ask a Financial Professional Any Question

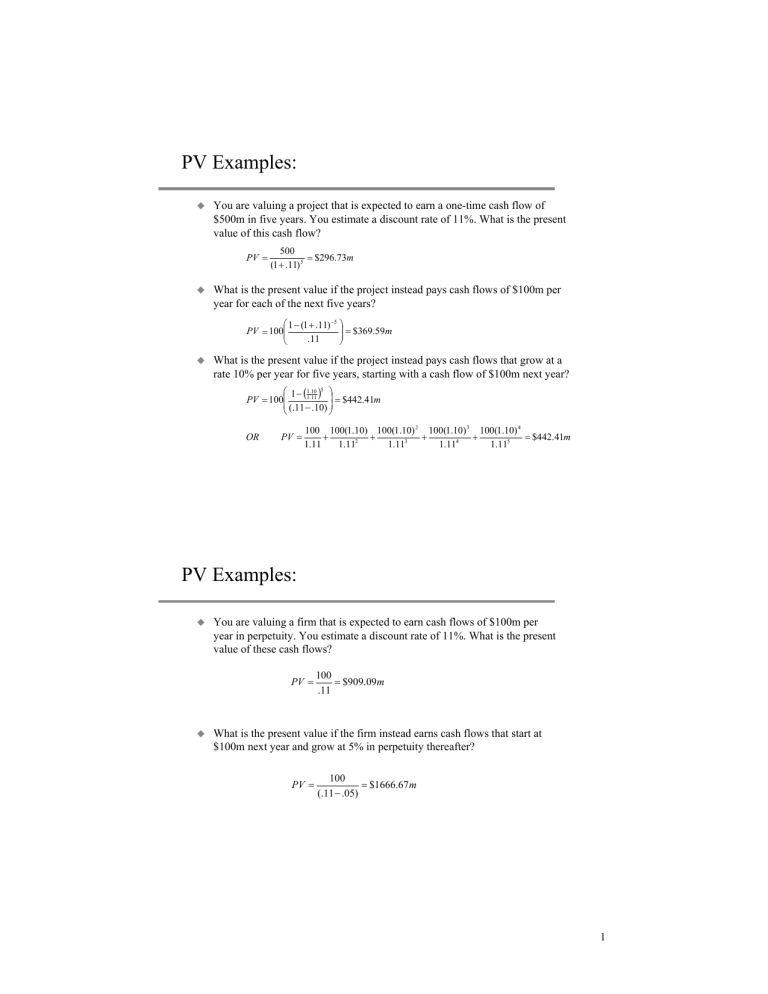

Present value calculator is a tool that helps you estimate the current value of a stream of cash flows or a future payment if you know their rate of return. Present value, also called present discounted value, is one of the most important financial concepts and is used to price many things, including mortgages, loans, bonds, stocks, and many, many more. The formula used to calculate the present value (PV) divides the future value of a future what really happens if you dont pay your taxes by april 15 cash flow by one plus the discount rate raised to the number of periods, as shown below. To calculate the present value of a stream of future cash flows you would repeat the formula for each cash flow and then total them. Fortunately, you can easily do this using software or an online calculator rather than by hand. For example, if you are due to receive $1,000 five years from now—the future value (FV)—what is that worth to you today?

When Might You Need to Calculate Present Value?

We’re going to assume that you (at least roughly) know how to calculate the FV. If you don’t, then don’t worry – just have a quick read of our sister article and then come back here. To figure this out, as with most things, when you’re working with different timeframes, it’s a good idea to work with the timeline. Thus, the Present Value ultimately just reflects how much something is worth right here, right now, in the present. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

Excel PV Calculation Exercise Assumptions

It helps in decision-making by considering the time value of money and determining whether an investment is financially viable. The present value, a.k.a. present worth is defined as the value of a future sum of money or cash flow stream at present, given a rate of return over a specified number of periods. The concept reflects the time value of money, which is the fact that receiving a given sum today is worth more than receiving the same amount in some future date.

Create a Free Account and Ask Any Financial Question

It is used both independently in a various areas of finance to discount future values for business analysis, but it is also used as a component of other financial formulas. Below is more information about present value calculations so you understand the factors that affect your money and how to use this calculator properly. This Present Value Calculator makes the math easy by converting any future lump sum into today’s dollars so that you have a realistic idea of the value received.

What is the approximate value of your cash savings and other investments?

The time value of money (TVM) principle, which states that a dollar received today is worth more than a dollar received on a future date. The present value of an amount of money is worth more in the future when it is invested and earns interest. Another advantage of the net present value method is its ability to compare investments.

It is practically compound interest calculation done backwards to find the amount you have to invest now to get to a desired amount in the specified point in the future. It is widely used in finance and stock valuation, although Net Present Value (NPV) is often preferred by experienced experts. The entire concept of the time value of money revolves around the same theory. Therefore, it is important to determine the discount rate appropriately as it is the key to a correct valuation of the future cash flows. Present value is a way of representing the current value of a future sum of money or future cash flows. While useful, it is dependent on making good assumptions on future rates of return, assumptions that become especially tricky over longer time horizons.

- If you don’t, then don’t worry – just have a quick read of our sister article and then come back here.

- If equations and / or math freaks you out, then it’s time to get past your fear.

- We’re going to assume that you’re more or less alright, so let’s actually just think about that equation in a little more detail.

- The word “discount” refers to future value being discounted back to present value.

And take your time to see how we’re discounting future cash flows to get to the present value. This formula is commonly used in corporate finance and banking, but is equally useful in personal or household financial calculations. The effects of compound interest—with compounding periods ranging from daily to annually—may also be included in the formula. Plots are automatically generated to show at a glance how present values could be affected by changes in interest rate, interest period or desired future value.

You can then look up PV in the table and use this present value factor to calculate the present value of an investment amount. You can think of present value as the amount you need to save now to have a certain amount of money in the future. The present value formula applies a discount to your future value amount, deducting interest earned to find the present value in today’s money. Imagine someone owes you $10,000 and that person promises to pay you back after five years.

Present value (PV) is the current valuation of a sum of money in the future. This works by the rule that the higher the discount rate is, the lower the present value of the future cash flows will be. Present value (PV) is the current value of a future sum of money or stream of cash flows. It is determined by discounting the future value by the estimated rate of return that the money could earn if invested. Present value calculations can be useful in investing and in strategic planning for businesses. The present value formula is essential because it allows individuals and businesses to evaluate the worth or value of future cash flows or investments in today’s terms.

When using this present value formula is important that your time period, interest rate, and compounding frequency are all in the same time unit. Thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward adjustment attributable to the time value of money (TVM) concept. Suppose we are calculating the present value (PV) of a future cash flow (FV) of $10,000. The present value (PV) formula discounts the future value (FV) of a cash flow received in the future to the estimated amount it would be worth today given its specific risk profile. Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.