Accounting Outsourcing: How to Hand off Your Financial Tasks With Recommendations

Too frequently, businesses and their account managers become weighed down by day-to-day issues, such as accounting entry mistakes, reporting mistakes, and software malfunctions. There are some easy-to-use accounting software that don’t require prior bookkeeping experience. However, to get the most out of accounting software, we recommend that you work closely with your accountant. If you only need basic accounting features like income and expense tracking, then you may benefit from free accounting software like Wave. Desktop accounting software can go as high as more than $1,000 per month, depending on the number of users included in the plan.

Accounting and Bookkeeping – Tips to Improve Profitability and Productivity

By outsourcing, companies can eliminate the need to hire and maintain an in-house accounting staff, subsequently cutting down on expenses such as salaries, benefits, and taxes. This allows businesses to reallocate resources to focus on their core operations and strategic initiatives, giving them a competitive advantage. It is important to note that labor costs are often one of the highest expenses for businesses, and outsourcing can lead to substantial cost savings. Accounting outsourcing is when a company hires a third party to handle its accounting and financial functions. Outsourced accountants handle various tasks, such as bookkeeping and payroll. They also manage financial reporting, taxes, and other account-related services.

What are the benefits of outsourcing accounting services for a small business?

The latter’s flexibility means they can quickly and resolutely resolve any past accounting issues and provide the exact services your business needs. You might choose to use document management software to keep track of key financial information and statements. You’ll want to periodically back up your files and ensure that you’re adhering to security protocols so your information isn’t compromised. For example, if you need to save a copy of a document separately from other files, you may put it in its own password-protected folder inside your document management software. Software programs, apps, and tools can save your business time and potentially money if you’re able to ensure more accurate accounting. Using a software program can also eliminate the need to retain a full-time accountant, which can add to your business expenses.

How to Read (and Analyze) Financial Statements

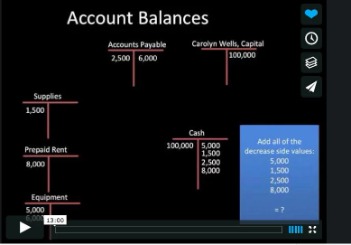

The best bookkeeping software syncs with your business bank account and payroll systems so that you’re easily able to import and export transaction history. We’ll cover some of the best business bookkeeping software options a little later. Some the statement of cash flows businesses might need basic bookkeeping, while others may require in-depth financial analysis or tax planning. To ensure you make an informed choice when hiring an accountant for small business, it’s important to ask the right questions.

What is the difference between cloud-based and on-premise accounting software?

Using accounting software can allow you to save time when managing the books for your business. You can sync financial accounts to easily import transaction history, track expenses, double-check transactions for accuracy, and generate important financial statements. Unlike the average non-accountant business owner, an outsourced accounting department has the time, resources, money, and training to focus solely on your business’s finances.

Outsourcing provides scalability, allowing businesses to easily adjust their level of service as required without the hassle of recruitment. Additionally, maybe you don’t need a whole new person on your staff https://www.accountingcoaching.online/the-allowance-method-accountingtools/ and you only need 10 extra hours a month. Professional accountants are well-versed in the complexities of financial transactions, minimizing the risk of errors in calculations, reporting, and compliance.

These tools can be helpful for automatically importing transactions from your bank accounts and payment processors like Stripe. And they generally cost less than hiring expert bookkeepers and accountants. That being said, the oversight and advanced reporting might make it worth the cost (and outsourcing definitely costs less than hiring a salaried controller). It will depend on your specific needs, but outsourcing could run in the ballpark of $2000–$3500 per month. Whether you’re filing solo or working with a CPA, we’ll do the books and work directly with a tax filing pro to get your taxes filed accurately and anxiety-free.

- Of all the outsourced accounting services, an outsourced CFO service is by far the most customizable.

- Before buying your software, talk with your current software users about what they see as the most important features.

- Their teams live and breathe accounting every day, and will replicate best accounting practices from across your industry into your business’s workflows, boosting efficiency and productivity.

- Clean and accurate books give your accountant less work to do and, ultimately, save you money.

- QX is your go-to partner for reliable, efficient, and high-quality accounting outsourcing services, committed to enhancing the operational effectiveness of CPAs and accounting firms.

Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to. If you’d like to outsource some or all of your accounting obligations, here’s how to get started. As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited. As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting..

Outsourced accounting and bookkeeping services are not just a cost-saving decision. Outsourcing will quickly help you address your talent shortage, which not only helps you scale but increases the scope of your firm. The latter is necessary as you don’t want your accounting firm to be limited to compliance tasks alone. Rather than just a few chosen tasks, outsourcing accounting enables you to offer bundled service offerings.

Some accounting software also includes bill pay and payroll software, so you can run payroll and manage other aspects of your business finances all in one place. But most small business owners should consider getting accounting software. Stop suffering and start saving time (and money) during tax season and throughout the year. And even if you, like me, love your spreadsheets and feel like you’ve got a good system in place? A firm can look out for things like tax credits, specialized loans, and other financial activities that a self-serve software won’t be able to provide guidance on. Having an accounting team in-house costs a lot of money than simply outsourcing them to a firm.

Almost all companies must pay taxes on their income, regardless of where they are headquartered. But preparing taxes and complying with regulations can be tricky, especially if your business has a complex https://www.wave-accounting.net/ corporate structure. Outsourcing these tasks to professionals allows you to better manage your cash flow, maintain healthy relationships with your suppliers, and more accurately gauge profitability.

Outsourced controllers are experienced accounting professionals who have worked with a diverse range of businesses. Additionally, when you outsource bookkeeping, you lose the ability to walk over to your bookkeeper’s desk and ask them a quick question. However, provided your outsourced bookkeeping partner embraces cloud-based accounting software, you’ll have access to your books 24/7. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377.