Preparing Income Statements for Manufacturing Companies

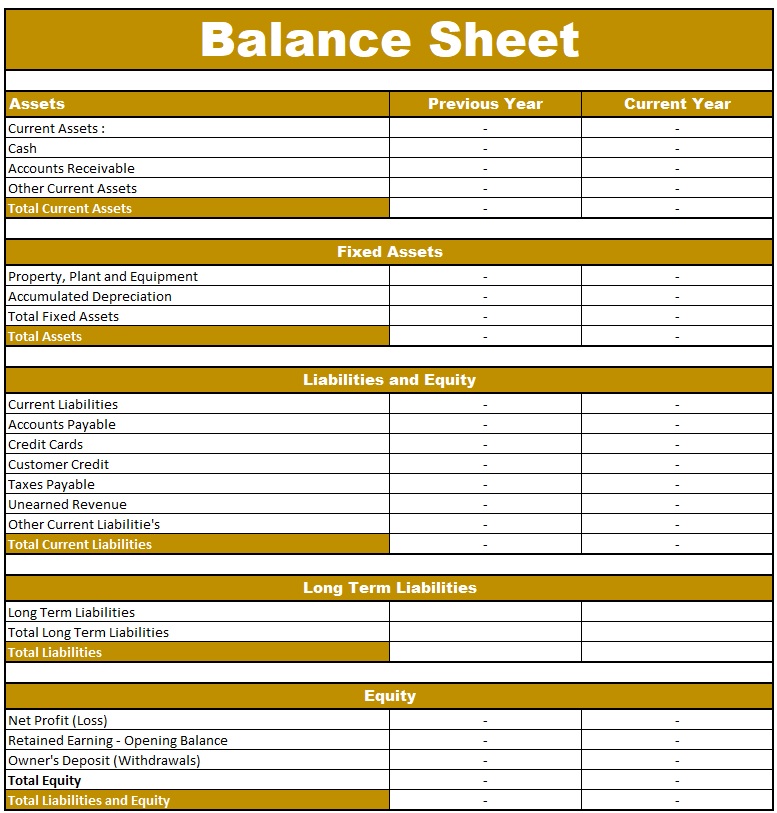

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP). Shareholders’ equity refers generally to the net worth of a company, and reflects the amount of money that would be left over if all assets were sold and liabilities paid.

What Are the Differences of the Balance Sheet and Profit and Loss Statement?

In Chapter 2 “How Is Job Costing Used to Track Production Costs?”, we look at an alternative approach to recording manufacturing overhead called normal costing. The diagram notes how the $500,000 of depreciation cost flows to the balance sheet and income statement components. Be aware that the illustration only shows dollar amounts related to depreciation; clearly there would be many other costs to consider.

- Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are.

- Using the cost flow equation, you can see how failing to record the $9,000,000 loss would understate cost of goods sold.

- A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands.

- Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet.

- There are many factors driving it.” As an example, the ultimate transaction price is often driven by customer contracts, margins, a track record, sound management, etc.

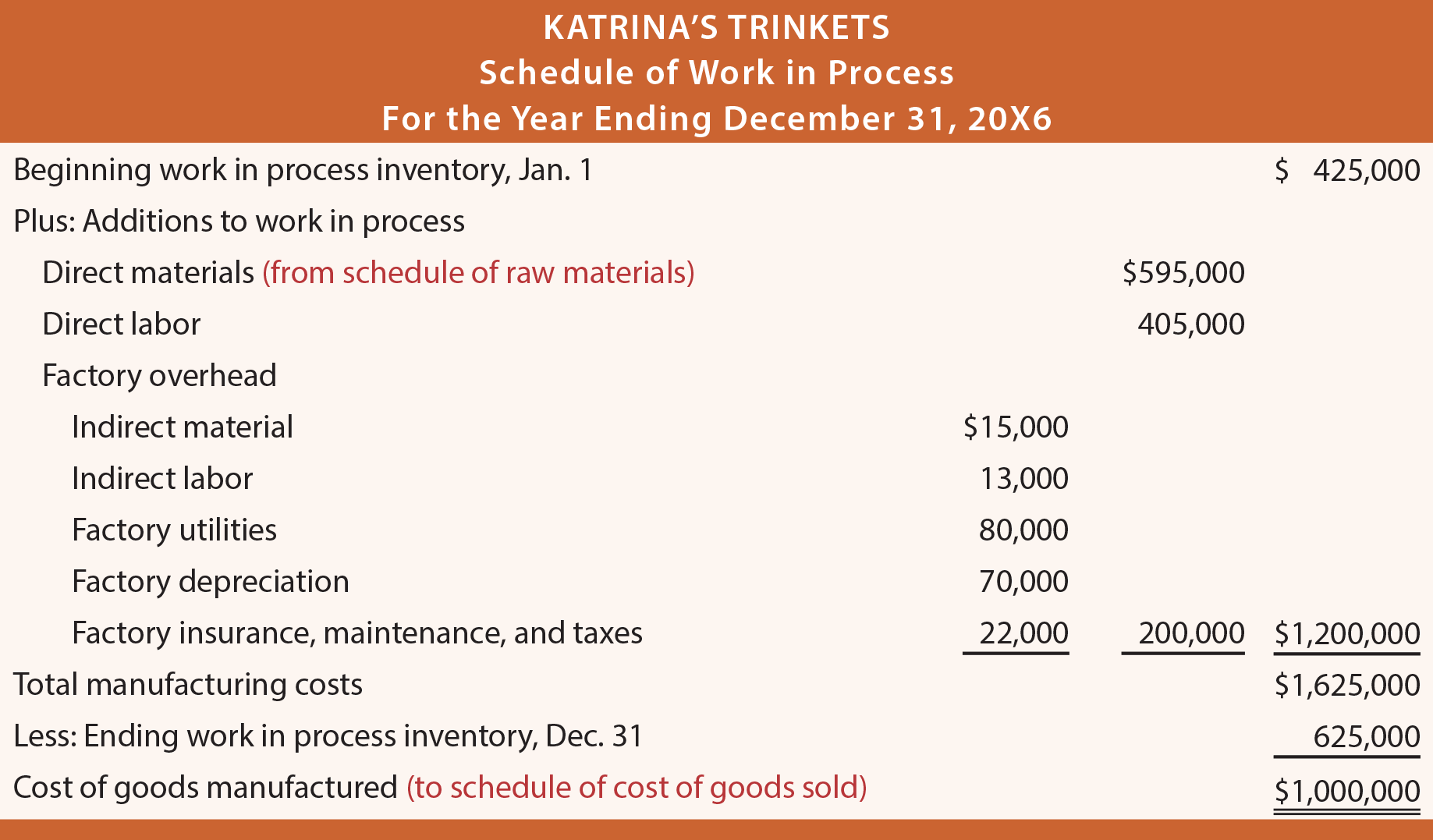

8 Income Statements for Manufacturing Companies

By failing to record the inventory loss, Rite Aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an expense) by $9,000,000 on the income statement. This ultimately increased profit by $9,000,000 because reported expenses were too low. The goal of going through the process shown in Figure 1.7 “Income Statement Schedules for Custom Furniture Company” is to arrive at a cost of goods sold amount, which is presented on the income statement. Custom Furniture Company’s income statement for the month ended May 31 is shown in Figure 1.8 “Income Statement for Custom Furniture Company”. In a real world scenario, the beginning and ending inventory amounts would be supported by a physical inventory and the purchases determined from accounting records. Or, Katrina might utilize a sophisticated perpetual system that tracks the raw material as it is placed into production.

Which of these is most important for your financial advisor to have?

Investors and creditors generally look at the statement of financial position for insight as to how efficiently a company can use its resources and how effectively it can finance them. While compiling these statements can be labor-intensive and prone to errors, their accuracy is crucial for maintaining a competitive edge. By leveraging insights from manufacturing financial statements, companies can make informed decisions that drive growth and enhance their market position. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. A balance sheet is a financial statement that communicates the “book value” of an organization, as calculated by subtracting all of the company’s liabilities and shareholder equity from its total assets.

Owners’ equity, also known as shareholders’ equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for. For that reason, we continuously develop products that can streamline business processes in all industrial sectors, no matter how big. With solutions like HashMicro, businesses can automate key processes, reduce errors, and enhance their overall financial management.

The income statement summarizes a company’s revenues and expenses over a specific period, ultimately showing net income or loss. Depending on the company, different parties best software for tax professionals may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

Figure 1.9 presents an income statement for Fashion, Inc., a retail company that sells clothing. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time. For example, investors and creditors use it to evaluate the capital structure, liquidity, and solvency position of the business. On the basis of such evaluation, they anticipate the future performance of the company in terms of profitability and cash flows and make important economic decisions. In the balance sheet, assets having similar characteristics are grouped together.

Katrina’s amounts are assumed, but actually would be derived from accounting records and/or by a physical counting process. For this company, observe that finished goods is just a small piece of the overall inventory. Finished goods is the cost assigned to completed products awaiting sale to a customer. But, this company has a more significant amount of raw materials (i.e., the components that will be used in manufacturing units that are not yet started) and work in process.

Some manufacturers consolidate raw material and WIP data into a single document known as the schedule of cost of goods manufactured. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet.

After you know the differences, you also need to understand the core components it has. Understanding the key components which are Cost of Goods Sold (COGS), Income Statement, Balance Sheet, and Cash Flow Statement allows stakeholders to make informed decisions about operations and investments. Each type of manufacturing financial statement plays a unique role in revealing insights into profitability, efficiency, and overall financial health. Understanding financial statements of manufacturing company is not just about compliance or basic reporting; it can be the key to discovering opportunities that drive growth and efficiency. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts.